Saudi Arabia Government invited my company Satari Ajikawo Investment Bank in Riyadh for Real Estates Development fund US $500 Billion (Neom) Utopian megacity project backup amalgamated land with Egypt, Jordan and Saudi Arabia hosted by Euromoney.

As well as opening up the 5,000-year-old wonders of Al-Ula, there are plans to develop 34,000 square kilometres of Red Sea coastline and 50 outlying islands into luxury beach resorts. The scheme has already attracted Satari Ajikawo Investment Bank, as its strategic investor and thus being involved in developing the islands. Saudi Arabia Government has caved out the land ending in Red Sea and thus allocated the land to strategic investor for Neom projects, having its own law, own currency, own culture, sovereignty and own future country name. In Shaa Allah

Dr. Kent Moors: the author of Energy Advantage confirmed analysis of NEOM.

Dubai, the crown-jewel city of the Middle East – is about to be eclipsed by NEOM, a new $500 billion, 10,000 square mile mega-city, right on the banks of the Red Sea! 33 times more thank New York. It will be built from scratch with enormous skyscrapers, the most modern transportation system ever made, world-class hotels, restaurants, casinos, and every imaginable luxury. For you, this means investing opportunities galore. Starting with one highly eclectic and visionary company (Satari Ajikawo Investment Bank) that is getting set to commit as much as $25 billion in the

Satari Ajikawo Financial Management Consultant Ltd

The strategic advisory, restructuring & recapitalization back up with independent board advice capital advisory business serves some of the largest companies globally in a broad range of industries, with expertise across sectors comprising 70% of global GDP. From offices in New York, London, Paris, Menlo Park and San Francisco, our professionals are dedicated to providing discreet and independent strategic and financial advice, unencumbered by institutional constraints or conflicts of interest.

Our partners have deep experience across the most complex public and private company transactions. More than that, the firm’s relationship-based approach with our clients means that our focus and expertise extends far beyond tra

Satari Ajikawo Financial investment Company Ltd

Operate as a private equity and uses funds to invest in private companies or buy out public companies. By doing so, general partners can obtain control over management and other operational changes to increase profitability in hopes to later sell at a successful rate.

Satari Ajikawo Digital Assets Ltd

Our mission is to deliver software and services that create a thriving, interconnected ecosystem. Our vision is the Satari Ajikawo Global Digital Network. Today’s blockchains provide a partial solution to the problem of siloed data, as they synchronize transactions between participating users. Still, boundaries remain between different blockchain deployments and between blockchains and traditional IT systems.

Digital Asset is changing how businesses and markets interact. Technology and trusted data are critical to success in an increasingly interconnected global economy—yet the software and systems underlying services and commerce are isolated, disconnected, and inefficient. Our technology works across traditional boundaries, creating interconnected networks where information and value flow freely.

Satari Ajikawo Airways Group

JetBlue and Virgin Australia are to be rebranded to Satari Ajikawo Airways Group. JetBlue have completed merger with Spirit Airlines for $3.8 billion. JetBlue operates over 1,000 flights daily and serves 100 domestic and international network destinations in the United States, Canada, Mexico, the Caribbean, Central America, South America, and Europe.

Satari Ajikawo Investment Bank Ltd

Foundein 2016, Satari Ajikawo Investment Bank is an investment bank based in London, United Kingdom. The firm offers mergers and acquisitions, divestitures, corporate defense, restructuring, and spin-offs, cross-border transactions, stock Trading, Bond, Option, Collateral Debts Obligation (CDO), Collateral Loans Obligation (CLO) and derivative transaction advisory services. The firm serves consumers, and healthcare, industrial, and manufacturing, natural resources, real estate, and technology, media, and telecommunications industries.

Satari Ajikawo Financial Group Ltd

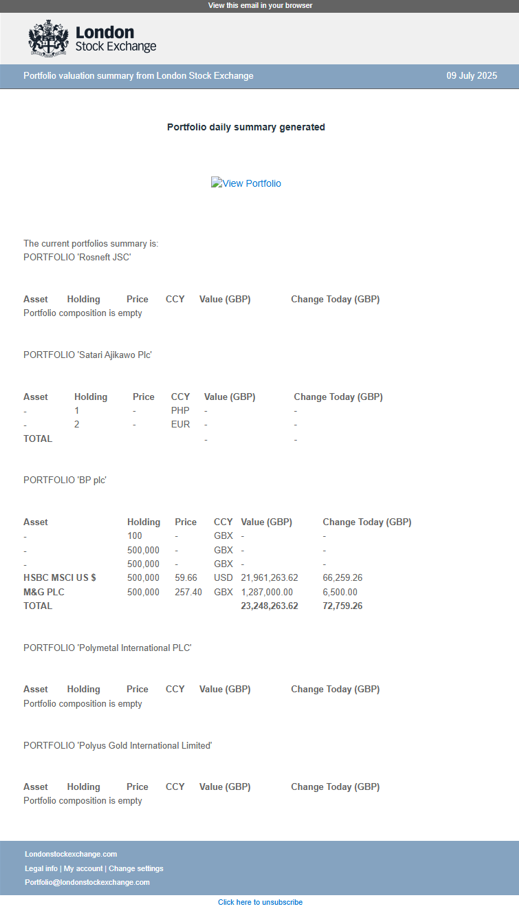

With majority ownership in with Qatar Investment Fund US$100 billion base in London, Majority ownership structure Sheikh Satari Ajikawo, having constituency in the following Assets:

1) QNB Group

2) Ooredoo Group

3) Qatar Airways

4) Qatari Diar

5) Harrods

6) UK National Grid Plc

7) The Shard

8) One Grosvenor Square

QNB Group has steadily grown to be the biggest bank in Qatar and the largest financial institution in the Middle East and Africa region.

For the financial year ended 31 December 2021, the Group’s Net Profit reached QAR13.2 billion (USD3.6 billion), an increase of 10% compared to the same period last year. QNB recorded total assets of QAR1,093 billion (USD300 billion), representing an increase of 7% from December 2020.

In 2016, QNB Group completed the acquisition of 99.88% stake in Turkey’s Finansbank A.Ş. (now known as QNB Finansbank), the 5th largest privately owned universal bank. In 2013, the Group successfully completed the acquisition of the second largest private bank in Egypt, QNB ALAHLI (QNBAA) with existing ownership of 95.00%. The Group has also extended its regional footprint by acquiring stakes in various financial institutions including a 20% stake in Ecobank Transnational Incorporated (Ecobank), the leading pan-African bank based in Togo, a 38.6% stake in the Jordan-based, the Housing Bank for Trade and Finance (HBTF), 40% of Commercial Bank International (CBI) based in the United Arab Emirates (UAE), 99.99% of QNB Tunisia, 54% of the Iraqi-based Al-Mansour Investment Bank, and a 20% stake in the Al Jazeera Finance Company in Doha.

QNB Group also retains a 51% stake in QNB-Syria, and a 92% stake in QNB Indonesia. Network expansion comes in support of the vision to become a leading bank in the Middle East, Africa, and Southeast Asia. In addition, the Bank is establishing a foothold in highly competitive markets, including Hong Kong, where the Group opened recently its first branch. The Group started operating in Vietnam in 2015 and Myanmar in 2016, along with opening new branches in KSA and India in 2017 QNB Group, currently ranked as the most valuable bank brand in the Middle East and Africa, is proud to be the Official Middle East and Africa Supporter of the FIFA World Cup 2022™. Through its subsidiaries and associate companies, the Group extends to more than 31 countries across three continents providing a comprehensive range of advanced products and services.

The total number of employees is 27,000 operating through 1,000 locations, with an ATM network of more than 4,500 machines.

QNB Group has maintained its position as the highest-rated bank in Qatar and one of the highest rated banks in the world from leading credit rating agencies including Standard & Poor’s (A), Moody’s (Aa3), and Fitch (A+). The Bank has also been the recipient of many awards from leading international specialised financial publications. The Group provides an array of investment banking services through its subsidiary, QNB Capital, to corporate, government and institutional clients within Qatar and globally. QNB Capital has one of the best corporate finance teams in the GCC region offering extensive transaction experience and in depth advisory – including mergers and acquisitions, equity and debt capital markets, and project financing advisory.

The Group also offers brokerage services through its subsidiary, QNB Financial Services (QNB FS), the first independently regulated, licensed brokerage company launched by a bank in Qatar. QNB FS offers a multi-market, multi-currency trading platform with access to several markets.

QNB Group has an active community support program and sponsors various social, educational and sporting events.

Satari Ajikawo Motors

Having majority owner structure in Tesla Inc, an American multinational automotive and clean energy company headquartered in Austin, Texas. Tesla designs and manufactures electric vehicles (electric cars and trucks), battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla is one of the world’s most valuable companies and, as of 2023, is the world’s most valuable automaker.

In 2022, the company had the most worldwide sales of battery electric vehicles, capturing 18% of the market. Through its subsidiary Tesla Energy, the company develops and is a major installer of photovoltaic systems in the United States. Tesla Energy is also one of the largest global suppliers of battery energy storage systems, with 6.5 gigawatt-hours (GWh). The Production of Electric Vehicle types are Model 3 Model S Model X Model Y Semi Powerwall, Powerpack, and Megapack solar panels and Solar Roof. www.Tesla.com

Satari Ajikawo Space Investment

The Space Exploration Technologies Corporation, commonly referred to as SpaceX is an American spacecraft manufacturer, launcher, and satellite communications company headquartered in Hawthorne, California. It was founded in 2002 with the goal of reducing space transportation costs to colonization of Mars. The company manufactures the Falcon 9, Falcon Heavy, and Starship heavy-lift launch vehicles as well as rocket engines, the Cargo Dragon and Crew Dragon spacecraft; and the Starlink mega-constellation satellite.

Space Exploration Technologies

Products

Launch vehicles

Rocket engines

Dragon capsules

Satellite constellation Starlink and SpaceBEE. www.SpaceX.com

Satari Ajikawo Real Estate Investment Trust

Canary Wharf is MadeFor Alienated Asset for Satari Ajikawo Real Estate Investment base in London, having being launched by Canary Wharf Group Plc, under the new brand name MadeFor subjected to change of control by Sheikh Satari Ajikawo with majority ownership structure.

Satari Ajikawo Real Estate Investment Trust has a global Residential and Commercial real estate may contain either a single family or multifamily structure that is available for occupation or for non-business purposes. Residences can be classified by and how they are connected to neighbouring residences and land.

Different types of housing tenure can be used for the same physical type. For example, connected residences might be owned by a single entity and leased out, or owned separately with an agreement covering the relationship between units and common areas and concerns. According to the Congressional Research Service. www.qataridiar.com

Satari Ajikawo Capital Alienated Assets Sequoia Capital

Satari Ajikawo Capital Alienated Assets Sequoia Capital is to Rebrand to SA capital. Sequoia is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors.As of 2022, the firm had approximately US$85 billion in assets under management.

Sequoia is an umbrella brand for three different venture entities: one focused on the U.S. and Europe, another on India and Southeast Asia, and a third on China.Notable successful investments made by the firm include Apple, Cisco, Google, Instagram, LinkedIn, PayPal, Reddit, Tumblr, WhatsApp, and Zoom. Sequoia Capital’s seemingly amicable divorce from its China and India businesses has the tech world talking, but few close watchers of the firm were surprised by the dramatic split.

The leaders of the three units-Roelof BothaNeil Shen and Shailendra Singh-told their limited partners that the breakup was in large part a result of conflicts that arose when different geographies invested in companies that could potentially compete with each other, but many observers I spoke to are doubtful that what the firm described in a letter to its LPs as “growing market confusion due to the shared Sequoia brand” is the main reason for the separation. Rising geopolitical tension between the US and China is an obvious catalyst for the high-profile split. But the rift between Washington and Beijing

Satari Ajikawo Capital

Bain Capital Alienated Asset to be Rebrand as Satari Ajikawo Capital. Bain Capital is an American private investment firm based in Boston. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences, crypto, tech opportunities, partnership opportunities, special situations and real estate.

Bain Capital invests across a range of industry sectors and geographic regions. As of 2022, the firm managed $165 billion of investor capital. The company is headquartered at 200 Clarendon Street in Boston with 22 offices in North America, Europe, Asia, and Australia. Since its establishment it has invested in or acquired hundreds of companies, including AMC Theatres, Artisan Entertainment, Aspen Education Group, Apex Tool Group, Brookstone, Burger King, Burlington Coat Factory, Canada Goose, DIC Entertainment, Domino’s Pizza, DoubleClick, Dunkin’ Donuts, D&M Holdings, Guitar Center, Hospital Corporation of America (HCA), iHeartMedia, ITP Aero, KB Toys, Sealy, Sports Authority, Staples, Toys “R” Us, Virgin Australia, Warner Music Group, Fingerhut, Athenahealth, The Weather Channel, Varsity Brands and Apple Leisure Group, which includes AMResorts and Apple Vacations.

The company and its actions during its first 15 years became the subject of political and media scrutiny as a result of co-founder Mitt Romney’s later political career, especially his 2012 presidential campaign. In June 2023, Bain Capital was ranked 13th in Private Equity International’s PEI 300 ranking of the largest private equity firms in the world.

Satari Ajikawo Sports Investment

Is now under construction

Satari Ajikawo PLC

Contact

I’m always looking for new and exciting opportunities. Let’s connect.

info@satariajikawo.org

020 8804 4924

A Multi-Sector Financial Vision

From founding Satari Ajikawo Ltd to launching a private investment banking entity, Sheikh Ajikawo has built a framework designed to span key economic sectors. His companies address everything from global wealth management and asset trading to sovereign investment and strategic consultancy. This multi-sector structure reflects a long-term plan aimed at creating financial ecosystems that connect governments, institutions, and private clients through scalable, diversified offerings.

Join Sheikh Satari Ajikawo’s journey in building a globally connected, innovation-driven financial enterprise.

© 2025 Satari Ajikawo Ltd